We provide our clients with a robust and challenging audit ensuring compliance with all the relevant Accounting and Assurance Standards issued by ICAI in India, US GAAP and International Standards, wherever so applicable. We take the time to get to know each and every client, whether large or small and simultaneously take the time to get to know everyone who is involved with the process, while encouraging them to provide their valuable insight into the industry.

We try to keep all our clients up-to-date with relevant financial reporting and related legislative and technical changes, through the year, while also providing appropriate advice to maximize the potential of their business.

In-depth study of existing systems, procedures and internal controls for proper understanding of the business. Recommendations are provided for improvement and strengthening.

Review of the financial statements to ensure that the same are prepared in accordance with Generally Accepted Accounting Policies and applicable Accounting Standards/IFRS.

Ensuring compliance with accounting manuals, policies, procedures and relevant statutes.

Enhancing risk management and corporate governance structure of the client.

Reporting efficiency of the business processes and are in consonance with the business objectives.

Checking the genuineness of the expenses booked.

Detection and prevention of leakages of income and suggesting corrective measures to prevent recurrence.

Conversion of financial statements for international reporting in accordance with major international standards such as IFRS & US GAAP.

Statutory Audits

Information System Audit

Concurrent Audits

Branch Audits of Banks

Audit of Charitable Trusts, Schools, Hospitals, etc.

Audit of Co-operative Societies

Management, energy and environmental audits, etc.

Internal Audits

Review of Internal Controls

Forensic accounting, fraud and investigation services

Due Diligence

Financial Accounting

Our audit approach is designed to achieve a consistent standard of audit service. Our audit methodology, approach and knowledge enable us to deliver a consistent, high-quality audit. The audit methodology is constantly reviewed to ensure that they are up-to-date with the latest changes in audit standards and procedures.

The services provided under this field are:

Preparation & maintenance of books of accounts.

Support in day to day transaction processing.

Compensation Structuring

Payroll Administration & Customised Payroll Reports

Statutory Compliances

Filing of Returns

Private equity advisory

Debt syndication

Structured Finance including preparation of project reports, preparation of CMA data, term loans, working capital limits, etc.

Valuations & fair value opinion

Restructuring Advisory

At every step, corporates have to comply with the plethora of provisions contained in legislations such as Companies Act 1956 and SEBI Regulations in case of listed companies.

Incorporation of company

Consultancy on Company Law matters.

Maintenance of Statutory records

Filing of annual returns and various forms and documents.

Clause 49 review for compliance with fiscal, corporate and tax laws

Secretarial matters including share transfers

Consultancy on Public/Rights/Bonus issue of shares.

Change of Name, Objects, Registered Office, etc.

We not only provide advice on ensuring compliance with them but also provide secretarial support with respect to incorporation of Companies in India as well as outside India.

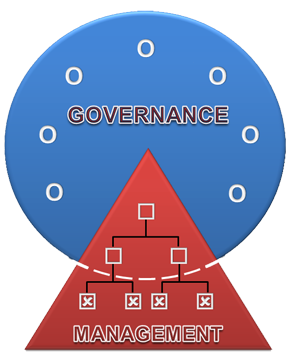

Corporate governance refers to a combination of laws, regulations, procedures, implicit rules and voluntary practices which help companies to perform efficiently and maximize long term value for shareholders and at the same time looking after the interests of other stakeholders like buyers, government, etc. We provide advisory and support services to enhance the levels of corporate governance within the organization. This includes:Corporate governance refers to a combination of laws, regulations, procedures, implicit rules and voluntary practices which help companies to perform efficiently and maximize long term value for shareholders and at the same time looking after the interests of other stakeholders like buyers, government, etc. We provide advisory and support services to enhance the levels of corporate governance within the organization.

This includes:

Periodic monitoring through internal audit

Review of Risk management and oversight functions in the organization

Strengthening of internal control systems & E-governance systems

Independent audit

Independent verification

Effective Supervision

Accountability

Sufficient number of Independent directors on the Board.

Formation of an independent audit committee for the board

Adequate disclosure and transparency in reports

Participation in board meetings.

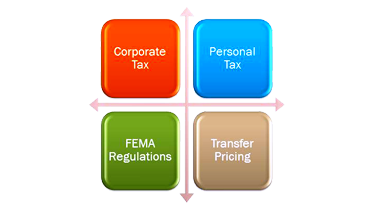

Our tax professionals are committed to give the quality and consistency to support the client’s tax function. Our team of professionals, with deep technical insight and practical, commercial and industry experience, is dedicated to help our clients manage direct tax compliances and reporting obligations effectively.

We can develop planning and compliance strategies that work best for our client’s business by in-depth understanding of tax issues and practical business skills. We not only understand the tax implications inherent to each of our clients, but can also design integrated solutions that minimize the client’s overall tax burden.

Our Corporate Tax services address the challenges thrown up by complex business environment in which the corporates operate in the following ways:

Providing advice and assistance across a spectrum of services relating to tax compliance, withholding tax advisory, and tax advisory & planning.

Providing regular updates on amendments, circulars, notifications & judgments.

Providing solutions for complex transactions or business arrangements, due-diligence support in business reorganisations and effective tax management and tax structuring.

Comprehensive assistance in addressing all Corporate Tax advisory and reporting needs on an on-going basis.

Providing opinions on the various Double Tax Avoidance Agreement related issues.

Assistance in the Corporate Tax compliances ranging from advance tax computation, preparation and filing of Corporate Tax returns, assistance with documentation requirements to support the planning and positions adopted and representations.

Litigation support and representations before the Appellate and Quasi-judicial authorities (Tax Tribunals and Authority for Advance Rulings) with special expertise in search, seizure and prosecution litigation..

Identifying threats and opportunities for providing innovative tax solutions to our clients.

Settlement of various issues raised under FEMA.

Our international tax professionals helps in managing tax burden by revealing opportunities, managing tax risks and meeting reporting obligations. We possess expert knowledge to address the tax challenges

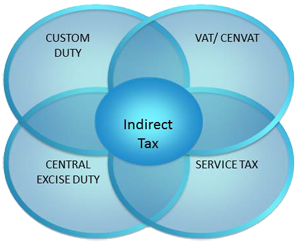

The Indirect Tax team at AVJ & Associates provides comprehensive advice and assistance for the complete range of Indirect Taxes viz., Customs Duty, Excise Duty, Sales Tax/ Value Added Tax, Entry Tax, etc.

We provide assistance in identifying risk areas and sustainable planning opportunities for indirect taxes throughout the tax life cycle. Our dedicated indirect tax professionals provide seamless, consistent service and deal effectively with cross-border issues. We provide you with effective processes to help improve your day-to-day reporting for indirect tax, reducing attribution errors, and reducing costs.

Our service offerings include the following:

Advisory and compliance services for classification, valuation, rates of duty, negotiations in contracts, benefits and exemptions, etc.

Special Economic Zones advisory services

Advisory on classification, valuation, duty liability, duty exemptions, credit availability, tax planning, etc.

Identification of planning opportunities to optimise duties

Analysis of Free Trade Zones

Compliances

Due Diligence

Advisory and compliance services for taxability of service, contract structuring, tax planning, exemptions and rebates, etc.

Consultancy for maintenance of documentation and accounting records.

Review of Cenvat credit

Assistance in availment of notified abatements

Assistance in Service tax audit

Due Diligence

Advisory and compliance services for taxability, rates of tax, assessments, concessions, exemptions and rebates, etc.

Assessment of financial impact of VAT/sales tax on businesses

Identification of structures to optimize VAT/sales tax incidence

We deal in providing a range of transaction advisory and support services to our clients which have enable us to gain experience appreciation of the dynamics involved in various transactions. It also enables us in blending practical business and commercial insights with financial, fiscal and regulatory knowledge.

Corporate Restructuring

Advisory on Merger and De-merger scheme

Advice on capital structuring, fund raising or buyback and repatriations.

Advisory on Business acquisition and divestment

Capital market advisory including matters concerning listing, de-listing, IPO's, rights issues and takeovers

Valuations & Business modelling

We work towards achieving an efficient transaction and investment, bearing testimony to exhaustive research, experience of implementation and threadbare discussion to various aspects of the deal.

Need Help with Your Personal Tax Return

Whether you are a company, sole trader firm, partnership or AOP -- you need to complete your tax return, we can help